what items are exempt from sales tax in tennessee

Some exemptions are based on the product purchased. Including industry updates new tax laws and some long-term effects of recent events.

Modernization Of Ag Sales Tax Passes Tn General Assembly Tennessee Farm Bureau

Contractors generally owe sales or use tax on the purchase price of the materials even when contracted by tax exempt agencies or organizations.

. Groceries is subject to special sales tax rates under tennessee law. At a total sales tax rate of 9250 the total cost is 38238 3238 sales tax. Tennessee lawmakers passed a special item in the 2022-23 budget that suspends sales tax on most groceries for the entire month of August beginning on August 1 and ending at 1159 pm.

Clothing with a price of 100 or less per item. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections. If you sell any.

In Tennessee certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. In the state of. This years state budget allocates for the entire month to be exempt.

During the holiday the following items are exempt from sales and use tax. Including industry updates new tax laws and some long-term effects of recent events. Sales and Use Tax Exemption Verification Application.

June 11 2021 1419. SUT-33 - Sale for Resale - Out-of-State Resale Certificates. This article has been updated to reflect the repeal of Sales and Use Tax Rule 96 and is effective January 10 2022.

This page discusses various sales tax exemptions in. Ad Avalara experts provide information to help you stay on top of tax compliance. Tennesseans will be able to purchase food and food ingredients without paying sales tax for the entire month of August.

Several examples of of items that exempt from Tennessee. For example gasoline textbooks school meals and a number of healthcare products are not subject to the sales tax. Rental of rooms lodging or other.

Sales Tax Holiday Keywords. These exceptions include medical supplies and packaging. Food is taxed at 4 instead of the state rate of 7.

In 2021 Tennessee honored a sales tax holiday three different times. The following is a press release from the National Coin Bullion Association announcing that Tennessee has become the latest state to have sales tax exemption on retail. Customers in the previous 12-month period are required to collect and remit Tennessee sales.

All state and local. Friday July 29 Sunday July 31 Clothing school supplies and computers. 67-6-228 state and local sales tax rates.

Tennessee Code Annotated Section 67-6-393. Vendors are often confronted with customers who wish to make purchases tax free either because they intend to resell the item. Services specified in the law that are subject to sales tax in Tennessee include.

Monday August 1 Wednesday August 31 Food. When are Tennessees sales tax holidays. The Blanket Exemption Certificate is utilized for all.

What Canadian Businesses Need To. Tennessee manufacturers can recover sales tax dollars erroneously paid on exempt items up to 3 years 36 months after the sales tax was paid. SUT-115 - Services Services Subject to Sales and Use Tax.

If a business qualifies as a manufacturer sales made from the qualified location of items not manufactured at that location but incidental to the businesss manufacturing sales. Exemptions for Tennessee Sales for Out-of-State Consumer Use 60 Films 61 Food 61 Fuel 61. School and school art supplies with a price of 100 or less.

In the state of Tennessee sales tax is legally required to be collected from all tangible physical products being sold to a consumer. The sales tax is comprised of two parts a state portion and a local. While the Tennessee sales tax of 7 applies to most transactions there are certain items that may be exempt from taxation.

The state of Tennessee provides only one form to be used when you wish to purchase tax-exempt items such as prescription medicines. Tennessee Code Annotated Section 67-6-393. Municipal governments in Tennessee are also allowed to collect a local-option sales tax that ranges from 15 to 275 across the state with an average local tax of 2614 for a total of.

Ad Avalara experts provide information to help you stay on top of tax compliance. Sales Tax Holiday Alphabetical Directory.

What Is A Sales Tax Exemption Certificate And How Do I Get One

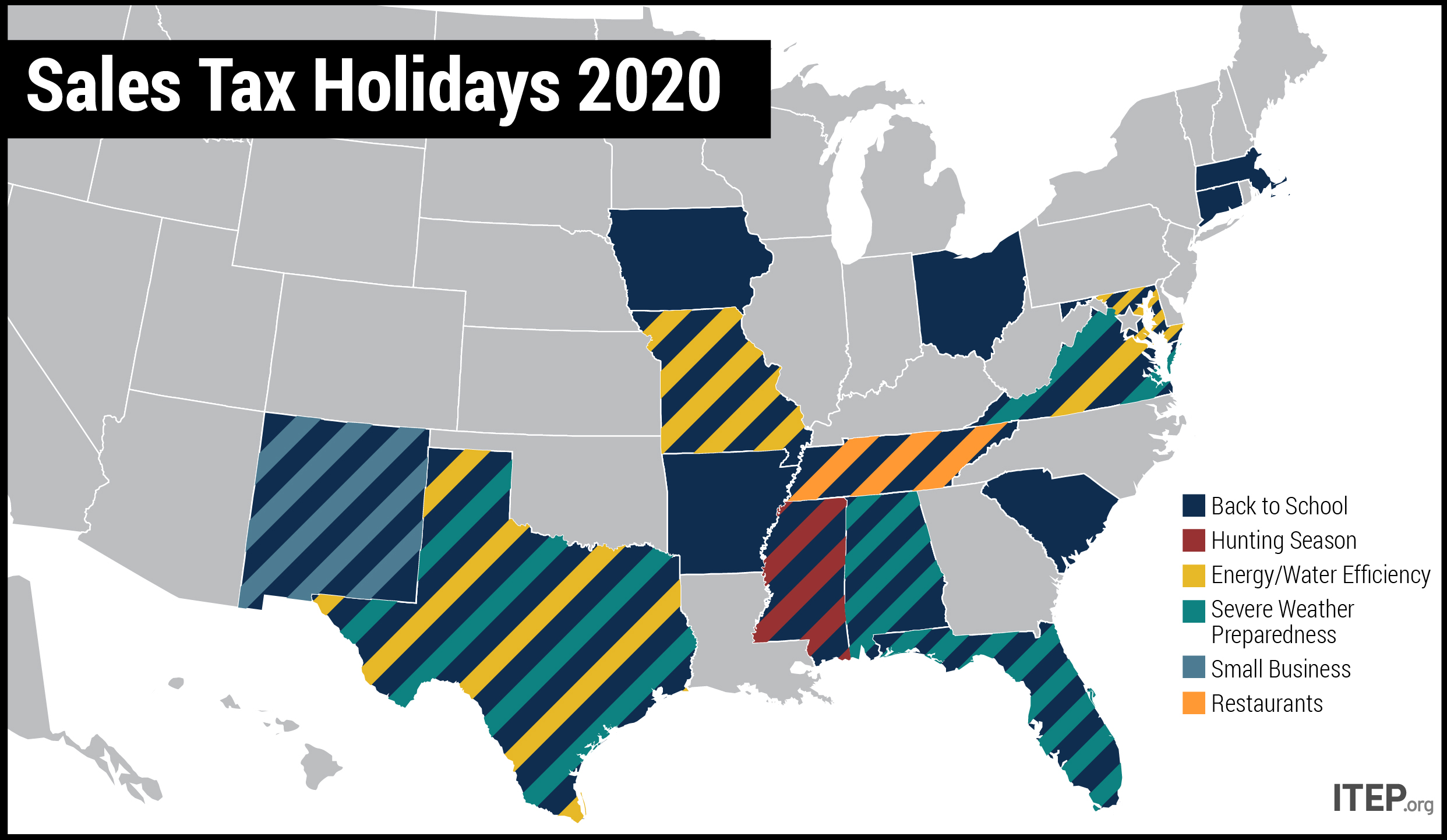

Sales Tax Holidays Politically Expedient But Poor Tax Policy

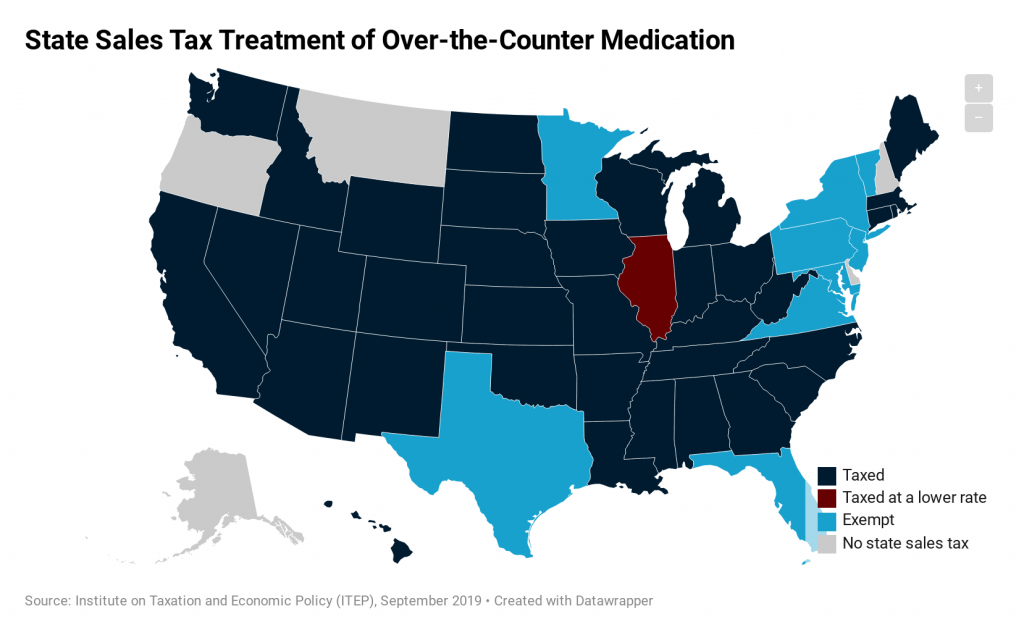

How Do State Tax Sales Of Over The Counter Medication Itep

Sales Tax Rates And Exemptions For Agricultural Manufacturing And Download Scientific Diagram

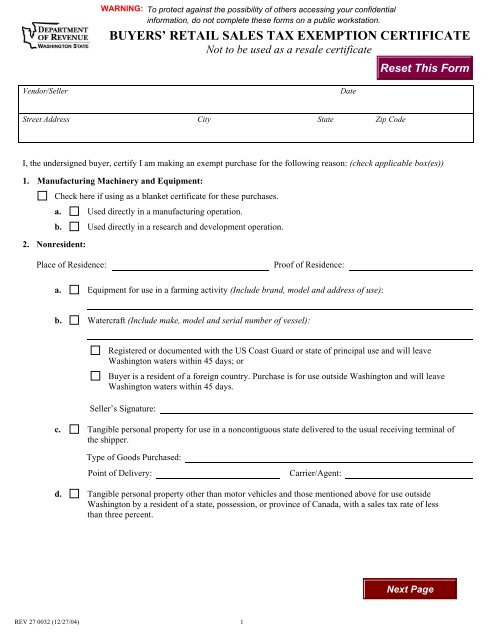

Buyers Retail Sales Tax Exemption Certificate

Washington Sales Tax Small Business Guide Truic

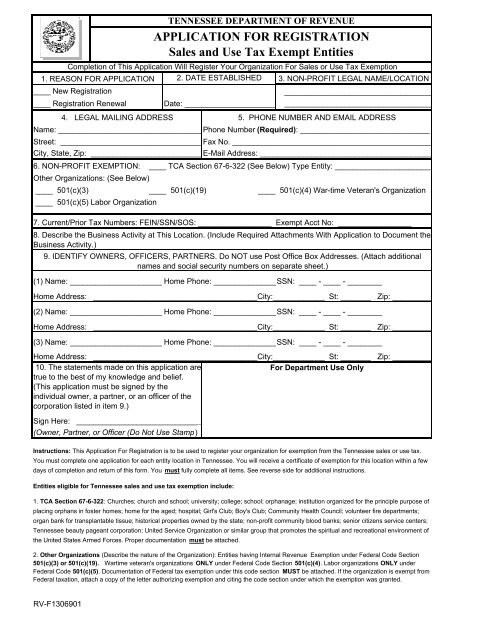

Tennessee Non Profit Sales Tax Exemption Certificate

States With Highest And Lowest Sales Tax Rates

Sales Tax And Tax Exemption Newegg Knowledge Base

Sales Tax Holidays An Ineffective Alternative To Real Sales Tax Reform Itep

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

List Of Tax Exempt Items Baby Receiving Blankets Emergency Kit Receiving Blankets

States Without Sales Tax Article

How Do State And Local Sales Taxes Work Tax Policy Center

Understanding California S Sales Tax

Sales Tax Exemption For Building Materials Used In State Construction Projects

Sales Tax On Grocery Items Taxjar

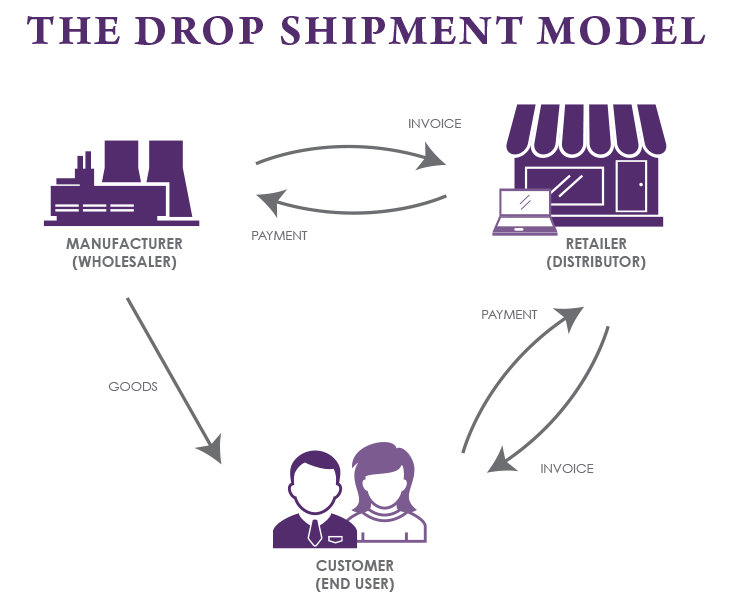

How Do Drop Shipments Work For Sales Tax Purposes Sales Tax Institute

Sales Tax Exemption How To Avoid Sales Tax In Trucking Youtube Trucks Tax Exemption Tax